After the demise of Lehman Brothers I recall reading an article about the end of structured products on Wall Street. The author's premise sounded logical given that the purchasers of Lehman structured products were considered unsecured creditors in Lehman's bankruptcy. Who would line up to "lend" money to a bank without either FDIC insurance or as part of the FDIC's Temporary Liquidity Guarantee Program? Hence, the end of structured finance. The end of a lucrative line of business for banks and, hopefully, less ways to lose money for investors.

After the demise of Lehman Brothers I recall reading an article about the end of structured products on Wall Street. The author's premise sounded logical given that the purchasers of Lehman structured products were considered unsecured creditors in Lehman's bankruptcy. Who would line up to "lend" money to a bank without either FDIC insurance or as part of the FDIC's Temporary Liquidity Guarantee Program? Hence, the end of structured finance. The end of a lucrative line of business for banks and, hopefully, less ways to lose money for investors.Thursday, February 25, 2010

Structured Products Are Alive And Well, Not Dead, Thanks To "Too Big To Fail"

After the demise of Lehman Brothers I recall reading an article about the end of structured products on Wall Street. The author's premise sounded logical given that the purchasers of Lehman structured products were considered unsecured creditors in Lehman's bankruptcy. Who would line up to "lend" money to a bank without either FDIC insurance or as part of the FDIC's Temporary Liquidity Guarantee Program? Hence, the end of structured finance. The end of a lucrative line of business for banks and, hopefully, less ways to lose money for investors.

After the demise of Lehman Brothers I recall reading an article about the end of structured products on Wall Street. The author's premise sounded logical given that the purchasers of Lehman structured products were considered unsecured creditors in Lehman's bankruptcy. Who would line up to "lend" money to a bank without either FDIC insurance or as part of the FDIC's Temporary Liquidity Guarantee Program? Hence, the end of structured finance. The end of a lucrative line of business for banks and, hopefully, less ways to lose money for investors.Thursday, February 18, 2010

Time To Tax Non-Profits

Politicians will resort to off balance sheet tricks such as Greece's recent admission, celebrate the Fed's "earnings" and dividend to the Treasury, and defer reality until retirement. If they admit that we face problems, more time will be spent blaming someone else than is devoted to solving the dilemma. Serious cost cutting will stay off the table until near the brink.

Politicians will resort to off balance sheet tricks such as Greece's recent admission, celebrate the Fed's "earnings" and dividend to the Treasury, and defer reality until retirement. If they admit that we face problems, more time will be spent blaming someone else than is devoted to solving the dilemma. Serious cost cutting will stay off the table until near the brink.Tuesday, February 16, 2010

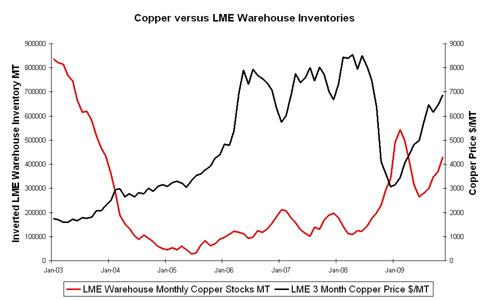

Copper Defies Supply And Demand

The rule of supply and demand states that as a commodity becomes scarser the price should rise. Conversely, as inventories grow, prices should weaken. The rule doesn't say how soon the price should rise or fall. You can go broke waiting for the rule to kick in. But, eventually people won't pay a lot for a commodity that is abundant.

The rule of supply and demand states that as a commodity becomes scarser the price should rise. Conversely, as inventories grow, prices should weaken. The rule doesn't say how soon the price should rise or fall. You can go broke waiting for the rule to kick in. But, eventually people won't pay a lot for a commodity that is abundant.Now let's look at the rise in copper prices.  The copper bull market corresponded with a reduction in inventories. But as stocks of copper have grown, the price of copper has decoupled. Instead of going down, price has been rapidly rising. Why and for how long? China is the reason most often mentioned.That and the weak US Dollar. Many believe that China was hoarding copper as an alternative to buying Treasuries, plus their lending and building boom would make good use of the metal. In fact China did buy over 40% of ALL copper in 2009. It's economy is no where near 40% of the world's economic output. Many feel that the Chinese have a huge inventory in addition to the LME and Shanghai warehoused inventories. Odds are that China will not be a 40% buyer in 2010. And the dollar has been anything but weak lately. Yet copper continues to rocket upward. If the Chinese have slowed their purchasing and the dollar has strengthened, what keeps copper up? Pure momentum and speculation. Some of the same economic recovery belief that the stock market sees. In fact, copper has been fairly well correlated with the S&P500 lately. Even speculators can read charts and when you read the inventory chart you should get scared. When producers like FCX say they aren't seeing enough pick up in demand to warrant capital investment that should be a warning that production is exceeding demand. As inventories continue to grow the price of copper will need to adjust downward. I haven't figured out how, or if, to profit from copper's mis-pricing. Shorting high beta stocks like FCX could get painful as could buying an inverse ETF. I'm going to keep thinking and exploring as I think copper is overblown. |

Monday, February 15, 2010

Are Longleaf and Fairfax Visionaries Or Just Stuck?

Years ago, like nearly everyone else who resided in Omaha, Nebraska, I drank the Level3 Kool-Aid. Level3 was an offshoot of Kiewit Construction and everything the Kiewit guys touched turned to gold. They built roads, tunnels, big buildings and mined coal and aggregates. They bought the failed Continental Can Company, stripped it and came out with huge profits. They started a fiber optic company that became the forerunner of MCI and sold it to WorldCom. Level3 was a do-over of a business that they had already made billions in and directed by the same management team that led the former success. Additionally, the managers and accountants of Kiewit would once again make sure the venture was run soundly. But Kiewit was a private company. You could only envy, you couldn't participate unless you worked there.

Years ago, like nearly everyone else who resided in Omaha, Nebraska, I drank the Level3 Kool-Aid. Level3 was an offshoot of Kiewit Construction and everything the Kiewit guys touched turned to gold. They built roads, tunnels, big buildings and mined coal and aggregates. They bought the failed Continental Can Company, stripped it and came out with huge profits. They started a fiber optic company that became the forerunner of MCI and sold it to WorldCom. Level3 was a do-over of a business that they had already made billions in and directed by the same management team that led the former success. Additionally, the managers and accountants of Kiewit would once again make sure the venture was run soundly. But Kiewit was a private company. You could only envy, you couldn't participate unless you worked there.Saturday, February 13, 2010

The Pension Bubble

The United States faces a ticking time bomb that needs to be defused. The threat is government pensions, almost all of which are seriously underfunded and poorly designed. Taxpayers are at risk of large tax increases, or significant cuts in services, unless changes are made. The problem exists at the federal, state, county, and city levels. It encompasses the general employee base as well as first responders. It's a large problem given the growth in government employment.

The United States faces a ticking time bomb that needs to be defused. The threat is government pensions, almost all of which are seriously underfunded and poorly designed. Taxpayers are at risk of large tax increases, or significant cuts in services, unless changes are made. The problem exists at the federal, state, county, and city levels. It encompasses the general employee base as well as first responders. It's a large problem given the growth in government employment.Lauren, I appreciate your desire to see Mount Dora not only retain it’s charm, but improve as the economy recovers. I share that vision. However, as a resident, and healthy taxpayer, I also expect my city to operate efficiently and show fiscal responsibility.

A major area of fiscal irresponsibility is the pension benefits currently offered to employees in the General Employee Pension Plan. I think it is entirely appropriate that the city council examines the Plan and, after study, makes changes. The current plan is not sustainable, for employees or taxpayers. Employees have not had a raise in pay for two years because the city could not afford it, largely due to an accelerating pension contribution. Not only the absolute dollars contributed to the plan, but the percentage of total payroll have skyrocketed. Additionally, investment performance has been poor. The combination of overly generous benefits and poor investment results has left the Plan in a seriously under funded position. A continued acceleration of this situation will affect all city services, as Plan contributions will take up larger and larger portions of the annual budget.

The goal of pension reform is not to harm employees. Some, however, would not have such a sweet deal. Others, the rank and file, could see paychecks actually increase as they currently pay up to 7% toward their pension plus 6% for social security. And, due to budget constraints, haven’t been receiving pay raises. Some employees may very well welcome a 401K Plan that allows them to keep a few more dollars of net pay and gives the city the flexibility to offer pay increases.

Let’s look at the Plan. It uses a .03 multiplier, and is generous on vesting, early retirement, final year income adjustments, and other components. What that means is that a long-term employee can retire with an income that exceeds his final pay level! For life! Mostly funded by taxpayers. An example: Multiplier [ .03 ] X years of service [30 years] X Final Pay. So, .03 X 30 =. 9 then, .9 X Final Pay, say, 80,000 =$72,000 PLUS Social Security of, lets say $25,000. resulting in a city/employee funded retirement income of $97,000. Remember, both city and employee pay 6% of income into social security. Most plans deduct that benefit from the pension, but the Mount Dora Plan doesn’t!

The over-riding question is should the taxpayer continue an employee’s income for life? Is 30 years of work worthy of that amount of compensation? In the past possibly as government salaries were not as generous as in private business, but for a long time city employees have enjoyed comparable pay scales.

The Council should solve the pension situation and also look at any other areas that affect the fiscal soundness of the city. Luckily for our community, the city isn’t burdened with a large debt load and if the Council acts diligently, it won’t become so.

Thanks for listening. Bill Kabourek

Wednesday, February 10, 2010

Are Central Bankers Throwing Life Preservers or Anchors?

Central banking 101 seems to view "financial rescue" as a virtuous deed. We saw this tenet put into action in the subprime crisis and it is about to emerge again in the coming European sovereign debt bailout. The problems are kicked down the road rather than addressed. CB101 states that it is better for all taxpayers to suffer later, so that creditors and investors don't feel immediate pain. It was put into effect to rescue Fannie and Freddie, and, it appears, the Germans and IMF are about to do an encore with troubled Euro zone borrowers.

Central banking 101 seems to view "financial rescue" as a virtuous deed. We saw this tenet put into action in the subprime crisis and it is about to emerge again in the coming European sovereign debt bailout. The problems are kicked down the road rather than addressed. CB101 states that it is better for all taxpayers to suffer later, so that creditors and investors don't feel immediate pain. It was put into effect to rescue Fannie and Freddie, and, it appears, the Germans and IMF are about to do an encore with troubled Euro zone borrowers.Tuesday, February 2, 2010

$30B For Small Business Lending A Boon To Banks

Jobs, Jobs, Jobs is the new mantra. One conventional way to create jobs is t0 foster a healthier small business climate as it is accepted that job growth begins with mom and pop companies. Since the administration has decided that small business job creation will not be encouraged by lower taxes, and instead will let the Bush tax cuts expire, the next best initiative would be to rev up small business lending.

Jobs, Jobs, Jobs is the new mantra. One conventional way to create jobs is t0 foster a healthier small business climate as it is accepted that job growth begins with mom and pop companies. Since the administration has decided that small business job creation will not be encouraged by lower taxes, and instead will let the Bush tax cuts expire, the next best initiative would be to rev up small business lending.Monday, February 1, 2010

Shameless Plug Time--Buy Men Who Are Making America

Technology is passing me by. Not only has Amazon's Kindle been very successful, the wife is buying one to avoid touching the lousy newsprint newspapers now use, but Apple has announced the debut of their new ITablet. Holding a book in one's hand will soon be reserved for us dinosauers. I hope assimilation takes awhile as I still have inventory in the basement!

Technology is passing me by. Not only has Amazon's Kindle been very successful, the wife is buying one to avoid touching the lousy newsprint newspapers now use, but Apple has announced the debut of their new ITablet. Holding a book in one's hand will soon be reserved for us dinosauers. I hope assimilation takes awhile as I still have inventory in the basement!