The rule of supply and demand states that as a commodity becomes scarser the price should rise. Conversely, as inventories grow, prices should weaken. The rule doesn't say how soon the price should rise or fall. You can go broke waiting for the rule to kick in. But, eventually people won't pay a lot for a commodity that is abundant.

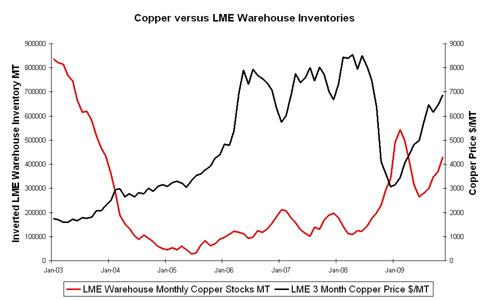

The rule of supply and demand states that as a commodity becomes scarser the price should rise. Conversely, as inventories grow, prices should weaken. The rule doesn't say how soon the price should rise or fall. You can go broke waiting for the rule to kick in. But, eventually people won't pay a lot for a commodity that is abundant.Copper seems to be defying the rule. Inventories have been increasing dramatically and so has price. London Metal Exchange physical inventory has doubled since August!

Now let's look at the rise in copper prices.  The copper bull market corresponded with a reduction in inventories. But as stocks of copper have grown, the price of copper has decoupled. Instead of going down, price has been rapidly rising. Why and for how long? China is the reason most often mentioned.That and the weak US Dollar. Many believe that China was hoarding copper as an alternative to buying Treasuries, plus their lending and building boom would make good use of the metal. In fact China did buy over 40% of ALL copper in 2009. It's economy is no where near 40% of the world's economic output. Many feel that the Chinese have a huge inventory in addition to the LME and Shanghai warehoused inventories. Odds are that China will not be a 40% buyer in 2010. And the dollar has been anything but weak lately. Yet copper continues to rocket upward. If the Chinese have slowed their purchasing and the dollar has strengthened, what keeps copper up? Pure momentum and speculation. Some of the same economic recovery belief that the stock market sees. In fact, copper has been fairly well correlated with the S&P500 lately. Even speculators can read charts and when you read the inventory chart you should get scared. When producers like FCX say they aren't seeing enough pick up in demand to warrant capital investment that should be a warning that production is exceeding demand. As inventories continue to grow the price of copper will need to adjust downward. I haven't figured out how, or if, to profit from copper's mis-pricing. Shorting high beta stocks like FCX could get painful as could buying an inverse ETF. I'm going to keep thinking and exploring as I think copper is overblown. |

No comments:

Post a Comment