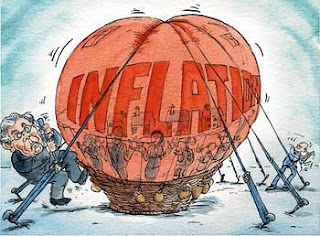

Deflation is on the Fed's mind and pundits propose that inflation isn't possible as long as banks aren't lending and excess reserves continue to pile up at the Fed. Those worries may be valid, but I sure seem to be feeling the impact of rising prices. Aren't rising prices inflation?

Deflation is on the Fed's mind and pundits propose that inflation isn't possible as long as banks aren't lending and excess reserves continue to pile up at the Fed. Those worries may be valid, but I sure seem to be feeling the impact of rising prices. Aren't rising prices inflation?Today's CPI release showed a tame inflation number, both headline and core. One of the key components of the CPI is the owners rent component, at appoximately 30 percent of the index, and that makes some sense as it is a major driver in consumer spending monthly. This number has been decreasing due to the depressed housing market, but I own my homes and see no benefit to this mythical benefit. Many other components may be statistically decreasing, but factually increasing.

I recently purchased a new car. It cost more than a few years ago because the manufacturer and dealer equip them better and the CPI calculators figure I've gotten better value, therefore, that equates to a price decrease. But I really didn't want a navigation system, super exterior and interior coating, and a sunroof. But I got them and I'm supposed to be happy that I really paid less, but my checkbook says differently.

The same is true about my favorite snacks. The prices have remained the same, but I get either fewer or smaller portions. I don't need the calories, but I'd like to have an actual lower price rather than a hypothetical one.

I had a guy out a few days ago to repair my cedar deck. He said he doesn't even bid a cedar job without calling the lumber yard to get the current quote as it has been rising consistently. Peachy! Cedar must not be in the CPI.

My mail a few weeks ago included a price increase from my health insurance carrier, American Republic Insurance, and, you guessed it, it was going to go up about $200 per month. Thank you President Obama and the non inflation calculating feds. Yesterday my car insurance went up $1200 per year because they switched a car from a Nebraska policy to a Florida policy. The non-insured driver component in Florida is out of this world and now I have to pay for it. I think I'll sell the car as we hardly use it, but none the less, that price sure didn't go down.

My nephew just told me of his tuition increases and they aren't going down. In fact, the increases in college tuition is darn near criminal and, once again. due to government mettling. If it weren't for student loans, universities would find a way to provide more affordable education in combination with parental support and part time work. No inflation here!

Take a look at all of your tax bills. Not the big ones, but the stealth ones. Cable, telephone, wheel, licensing, fees, they're all going up and governments are becoming more creative daily.

If it doesn't qualify as inflation, it surely affects my pocketbook negatively.

You get the idea, prices that real people pay are rising no matter what the CPI calculates out to be. You may get a great deal on a house or boat, but if you aren't in the market, that doesn't help. Prices are rising for day to day expenses and that continues to crimp the consumer. Don't look to Washington, or Obama, for help as they are about to make things worse by raising taxes and decreasing deductions by the elimination of the Bush tax cuts. Once again, that may not appear in the CPI, but it's a price increase and price increases don't create prosperity.

I hope I'm just old and cranky, but it sure feels like I'm paying more all the time and Washington's policies aren't helping.